“Strategic Combinations”: A Hybrid Deal Structure

By Billy Pritchard

Apr 06 2023

By: Billy Pritchard

As founders begin to consider various capital transactions for their business, they are often focused on two primary deal structures: 1) selling 100% of the business to a strategic buyer, or 2) partnering with a private equity firm through a recapitalization. Depending on the personal objectives of the founders, as well as the needs of the business, one of those deal structures can be a great fit for that specific circumstance.

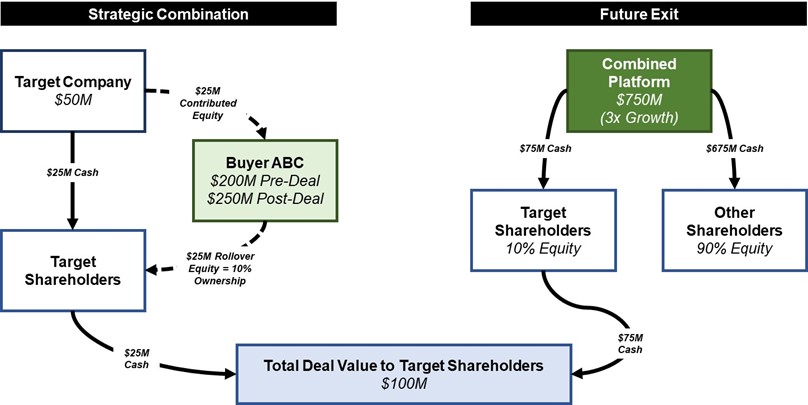

However, there is a third deal structure that is worth considering: a Strategic Combination. A strategic combination brings both the benefits of a traditional buyout and the flexibility and alignment of interests found in PE recaps. The key component to a strategic combination is the selling shareholders receive a portion of the purchase price in the form of rollover equity in the combined platform, giving them the ability to participate in a future exit of the platform. This option has certainly become more prevalent in today’s market, as new platform investment activity has become more challenging and private equity groups continue to put capital to work by pursuing tuck-ins for their existing platforms.

Deal Structure Overview:

- Selling shareholders of the target company agree to sell 100% of the equity interests to a strategic buyer (most often PE backed) in exchange for a combination of cash at closing and rollover equity.

Buyer ABC agrees to acquire 100% of Target Company for $50 million. The Purchase Price would be comprised of $25 Million cash at close and $25 million in rollover equity interest in Buyer ABC.

- The target company is consolidated into the combined legal organization of the acquiror, but it is often times left to operate in a loosely integrated or status quo basis.

- The newly combined platform looks for ways to accelerate growth of both business units through complementary synergies such as cross-selling of complementary products, combination of complementary business functions, or diversification of revenue streams.

- Ideally, this compounding growth (1+1 = more than 2) can drive the combined platform to a future exit event in a shorter time horizon and at a higher valuation.

- At the next exit, selling shareholders of the target company are able to monetize their rollover equity at a multiple of the initial value, allowing them to participate in the continued growth of their business and realize additional upside.

Illustrative Example:

Below is an illustrative example of a $50 million Enterprise Value business (“Target Company”) combining with a $200 million Enterprise Value business (“Buyer ABC”), with a future exit scenario at 3x Enterprise Value growth.

Key Benefits of a Strategic Combination:

- Alignment of Interests: With a strategic combination, the management team and existing selling shareholders have the opportunity to participate in the equity upside of the business going forward. This creates alignment of interests between the management team, existing selling shareholders, and the PE-backed strategic buyer.

- Access to Capital: By partnering with a PE-backed strategic, the business gains access to additional capital to support its growth initiatives. This capital can be used to invest in new product development, expand into new markets, or make additional strategic acquisitions.

- Business Synergies: In addition to better access to growth capital, a strategic combination creates new opportunities for growth for the business in the combined platform through synergies such as cross-selling of complementary products. These synergies can accelerate growth for a business in a more material way than it would achieve on its own.

- Retention of Key Talent: In a strategic combination, the existing management team is typically retained and incentivized to continue to drive the growth of the business. Additionally, key talent will be presented new opportunities for career development in the combined platform. This can help to retain key talent and ensure continuity in the business.

- Diversification of Wealth: By taking some cash at closing and rolling over a portion of their equity, the existing shareholders have the opportunity to diversify their wealth while maintaining a meaningful ownership stake in the business. This can be particularly attractive for founders who have a significant portion of their net worth tied up in the business, yet are hesitant to fully “cash out” due to future growth potential.

Have you considered this deal structure for your business? Are you able to grow your business independently to achieve the same total proceeds that you could realize through a strategic combination? Will your business perform better alongside a strategic partner.

These are important questions for founders to properly assess in today’s environment. For more information or an exploratory conversation, please reach out to our Technology Practice.