How Enterprise Value Translates to Net Transaction Proceeds

By Billy Pritchard

Jul 01 2021

Guest article by Billy Pritchard, vice president at Founders Advisors.

In the world of private capital transactions, deal values and statistics are discussed primarily using the Enterprise Value metric. The term “Enterprise Value” is often defined as the total value ascribed to the business, inclusive of both the company’s equity and the debt used to finance operations. When deal values are reported publicly, or through other proprietary databases, we tend to see Enterprise Values for those transactions quoted as a multiple of EBITDA or Total Revenue. EV is an important metric in an investment banking process for several reasons: i) it allows buyers to state a value of the company based on true operational performance, regardless of capitalization and ii) it is the cleanest way for Sellers to compare and discuss different offers on an apples-to-apples basis. However, for many founders of private businesses, Enterprise Values often do not tell the complete story of what a transaction means to them individually.

The adage “Not all Enterprise Values are created equally” is used often around our firm. When reviewing the full scope of an offer to buy a business, the headline Enterprise Value is just a starting point as we determine the true value of the offer. Certainly, a primary factor to consider is the type of transaction (i.e., buyout vs. recapitalization) and the structure of any rollover equity consideration in a recapitalization. Equity preferences and coupon rates can make two similar EVs vastly different from a long-term perspective. However, even in a comparison between offers of 100% buyouts, there are a multitude of factors that sellers should consider in addition to the headline Enterprise Value.

During the decision-making process, we look to equate all offers to a Net Transaction Proceeds amount for our clients. In other words, once the deal closes, how much will the shareholders collectively receive from the transaction net of closing adjustments, debt-like items, escrows, and other transaction expenses? As a founder considers a potential liquidity event, they need to fully understand the Net Transaction Proceeds amount in order to plan for the future and make an informed decision on whether a transaction at the stated Enterprise Value trumps another competing offer or outweighs the benefits of retaining the business.

Discussed below are several variables that will impact how Enterprise Value translates into Net Transaction Proceeds. With most of these variables, a lot of time and energy is spent negotiating the specifics of each during the closing process. Sellers should have a complete understanding of these variables and how to approach those negotiations early in the process in order to maximize their Net Transaction Proceeds.

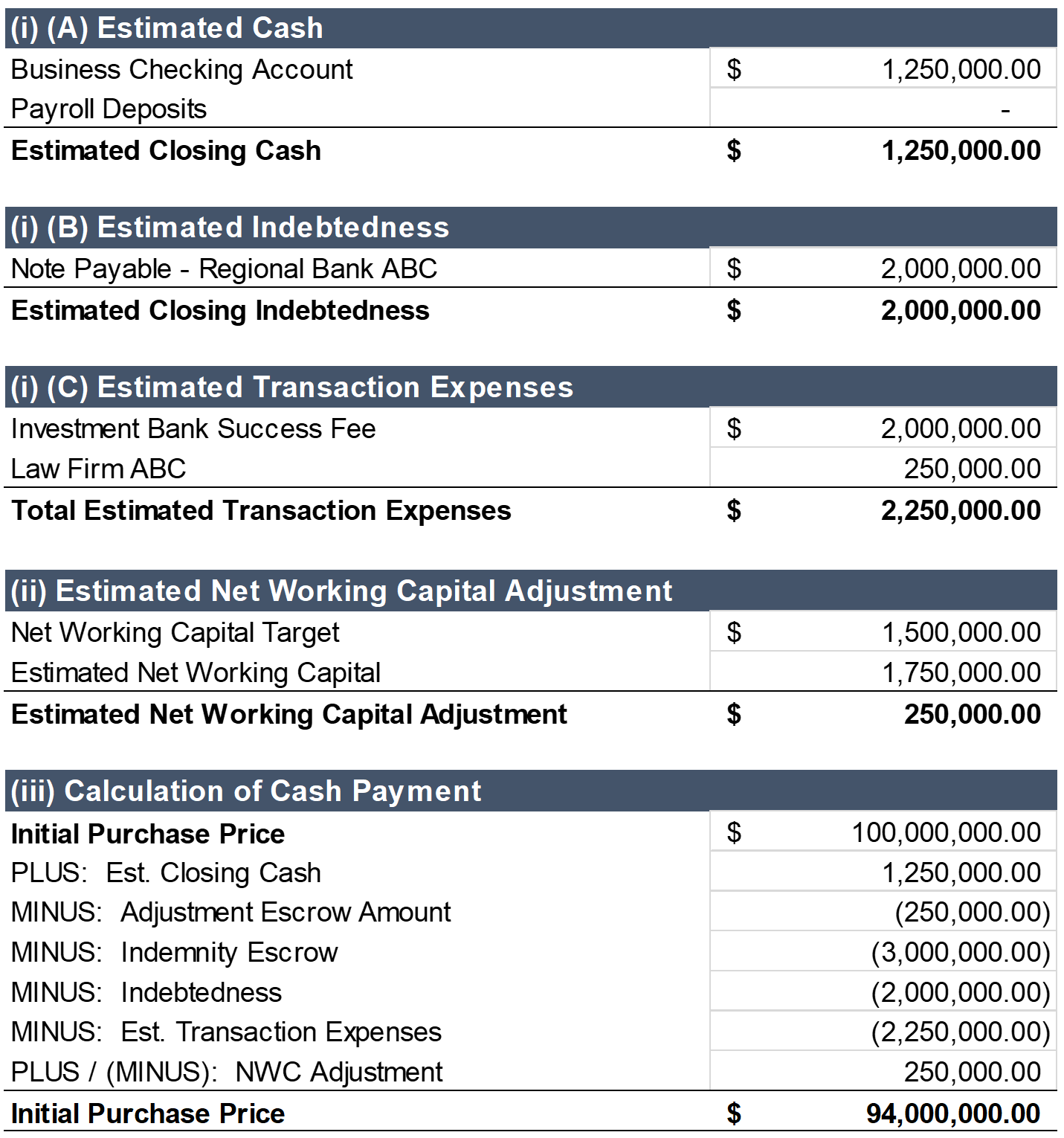

Let’s look at an example and discuss the various structural components that create the bridge from a $100 Million Enterprise Value to a true Net Transaction Proceeds Amount (in this scenario, $94 Million).

Letter of Intent Language

In this hypothetical example, a founder will see language in a Letter of Intent ascribing value of $100 Million to the business. That language would likely be worded as follows:

We propose to acquire 100% equity of the Company, on a cash-free, debt-free basis, at an Enterprise Valuation of $100 Million. The Enterprise Valuation is based on the Trailing Twelve Months EBITDA of $10 Million. The Purchase Price, subject to standard closing adjustments, will be paid to the Sellers upon successful completion of the definitive transaction documents.

The remainder of the Letter of Intent may discuss a few of the key closing adjustments at a high level (like an Escrow Amount range), but most Buyers will need to complete various levels of their due diligence before agreeing to specific terms and amounts. It is prudent for a Seller to push for an LOI with as much detail as possible for key structure terms. However, Buyers will be hesitant to commit with conviction without a deeper level of due diligence.

Stock Purchase Agreement Language

Once diligence is underway and legal documents are in process, language will be negotiated in the Purchase Agreement to formalize the terms and the amounts of many closing adjustments. The language in a Stock Purchase Agreement for this hypothetical would likely be structured as follows:

The “Initial Purchase Price” shall be an amount equal to (i) $100,000,000 (the “Enterprise Value”), plus (ii) Estimated Closing Cash, minus (iii) the Adjustment Escrow Amount, minus (iv) the Indemnity Escrow Amount, minus (v) the aggregate amount of Indebtedness of Seller, minus (vi) the aggregate amount of Estimated Seller Transaction Expenses, plus or minus (vii) the Estimated Net Working Capital Adjustment.

Each of these variables will have separate definitions in the Purchase Agreement, and the negotiations will be centered on what those definitions include or exclude in order to land at an estimated amount for each at the time of closing. While a true-up period will exist post-closing to clean up any missed estimates at the closing table, the negotiated definitions will control the post-closing adjustment process.

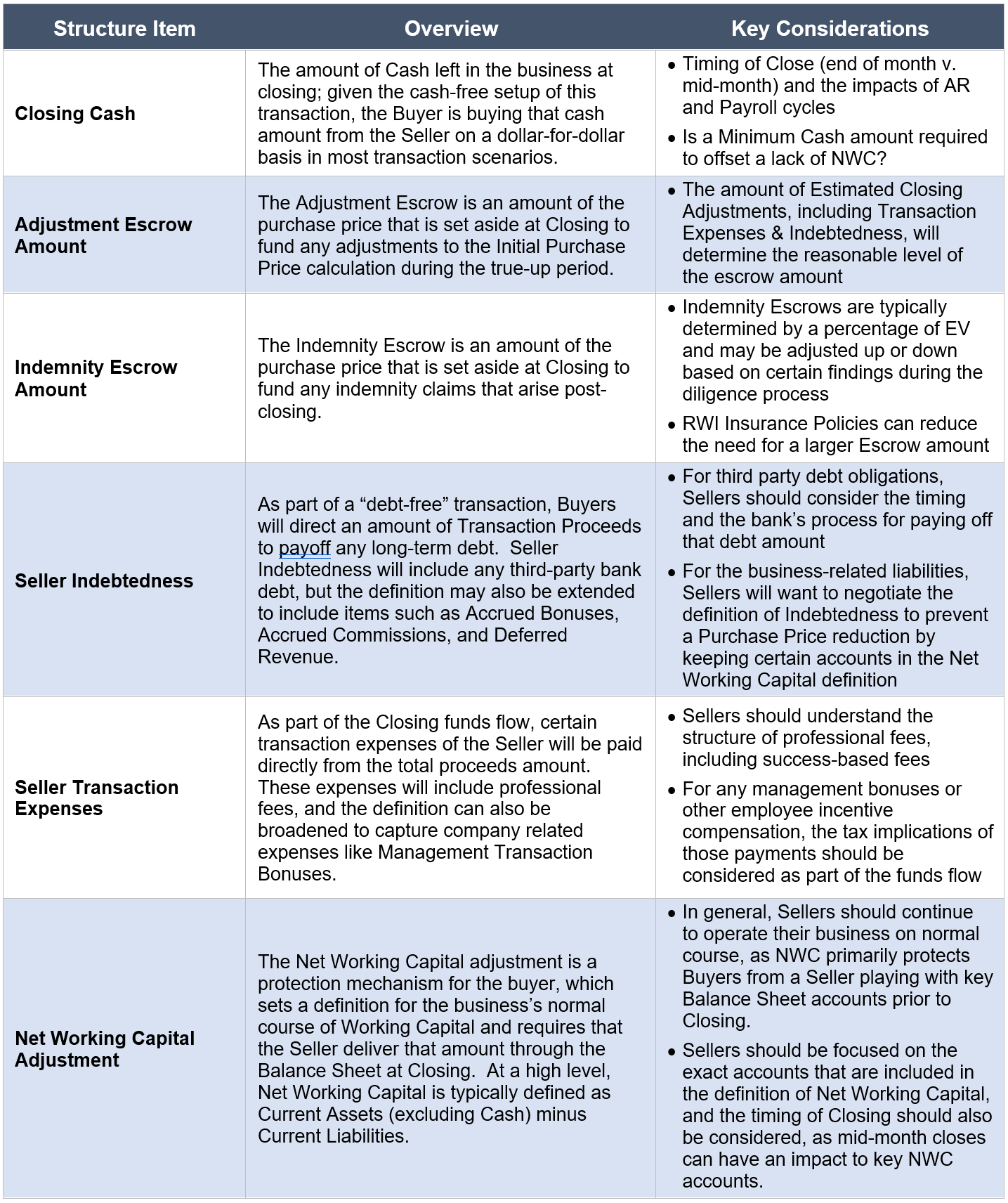

Key Closing Adjustments

In the chart below, we have highlighted several of the common closing adjustments and some key considerations when thinking through how each will impact the Net Proceeds amount.

Sample Closing Statement & Proceeds Calculation

Below is an example of a Closing Statement, which would be including in the Transaction Closing documentation, showing the impact of each adjustment to the closing proceeds (“Initial Purchase Price” in this example):

Summary Thoughts

- “Not all Enterprise Values are created equally.”

- Sellers, along with a team of experienced advisors, should look at a Net Transaction Proceeds estimate early in the sell-side process to fully understand the impact of the potential transaction.

- While Letters of Intent are formal offers, they will likely remain vague on key structure items that can materially impact a Seller’s Net Transaction Proceeds.

- The definitions of each Closing Adjustment should be carefully reviewed and negotiated by the Seller’s team during the legal negotiation process.

- Sellers, along with their advisory team, should be prepared to deliver specific closing day estimates based on the definitions of each Closing Adjustment.

- An experienced sell-side advisor should prepare Sellers for this process by introducing a comprehensive Proceeds Analysis or Flow of Funds model prior to a decision at the Letter of Intent Stage.