What to Expect When Transacting – Managing the Emotions of a Process

By Billy Pritchard

Aug 09 2023

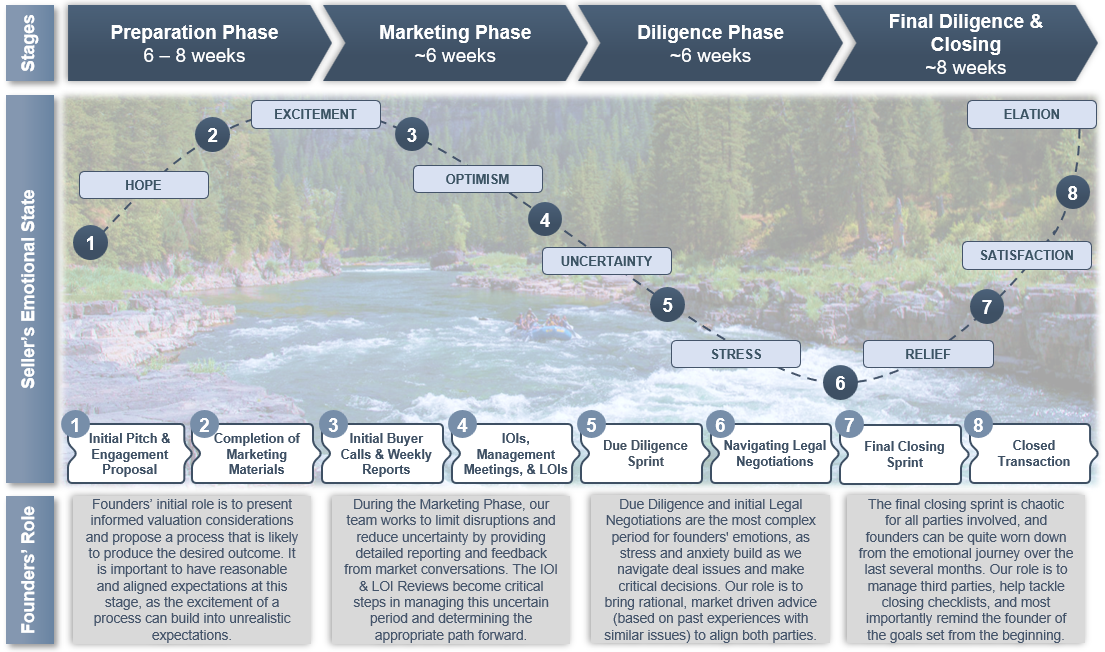

As founders begin to pursue a sellside transaction process, it is important to understand the various phases of process execution and the emotional cycles that will most likely come with each phase. Our team is a firm believer that, often, the most value we can add to these processes is helping manage the founders’ emotions throughout the journey.

We use the river guide analogy frequently – we are experienced on the water and have been through these rapids before…our job is to highlight what is around the next bend, coach our clients through navigating those sections, and ensure we increase the probability of reaching the takeout safely. In a typical sellside transaction, the emotional cycles tend to be the biggest “rapids” to navigate. The graphic below lays out a common emotional journey that founders experience through the four key stages of a sellside process. While there is no perfect way to fully prepare a founder for this unique experience, we believe this roadmap can help a founder reduce the emotional tension and maintain a steady and balanced approach to the typical challenges in a sellside process.

In short, “it takes what it takes” to complete a business transaction. However, a general awareness of how emotions enter and influence the transaction process, along with an experienced guide to get through those rapids, is critical to delivering a successful outcome.